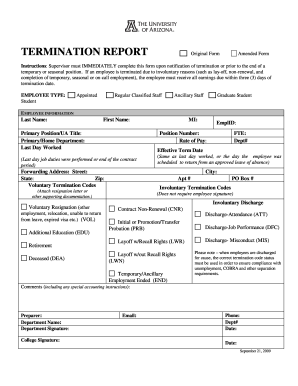

Payroll Notice of Employee Termination 2007-2024 free printable template

Show details

NOTICE OF EMPLOYEE TERMINATION Please notify Payroll USA by fax 941/727-1039 as soon as possible to ensure proper documentation. Employee Name: SS# or EE #: Employee Address: Home Phone: () Date of

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your federal labor department form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal labor department form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal labor department online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irs deductions form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

How to fill out federal labor department form

How to fill out federal labor department?

01

Obtain the necessary forms: Start by visiting the official website of the federal labor department or contacting them directly to get the required forms. These forms may vary depending on the purpose of your filing, such as an application for workplace safety or a wage complaint.

02

Provide accurate and detailed information: Make sure to provide all the necessary information on the forms accurately. This includes personal details, such as your name, contact information, and social security number, as well as specific details related to your case or application.

03

Attach supporting documentation: Depending on the type of filing, you may need to attach various supporting documents to your application. This could include evidence of wage payments, medical reports, or relevant contracts. Make sure to review the requirements carefully and include all necessary documentation.

04

Review and double-check: Before submitting your filled-out forms, take the time to review them thoroughly. Double-check for any errors or missing information that could potentially delay the process or negatively impact your chances of a successful outcome.

Who needs federal labor department?

01

Employees: The federal labor department is vital for employees who may need assistance with various workplace-related matters. This can include concerns related to wages, workplace discrimination, employment rights, safety violations, and other issues that fall under federal labor laws.

02

Employers: Employers also need to be familiar with the federal labor department to ensure compliance with labor regulations. They may need guidance on matters such as hiring practices, minimum wage requirements, workplace safety standards, and proper record-keeping.

03

Job Seekers: Individuals seeking employment can benefit from the services provided by the federal labor department. They offer resources such as job search assistance, training programs, and career development services. These can help job seekers enhance their skills, explore new opportunities, and connect with potential employers.

Fill form : Try Risk Free

People Also Ask about federal labor department

What happens when you complain to HR about your manager?

What does the US Department of Labor do?

Which federal agency is part of the Department of Labor?

How do I file a complaint against an employer in Michigan?

How do I file a complaint against an employer in Florida?

How do I complain about my boss professionally?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is federal labor department?

The federal labor department, also known as the United States Department of Labor (DOL), is a government agency responsible for ensuring safe and healthy working conditions, protecting workers' rights, promoting fair and competitive wages, and administering various federal employment laws and programs. It enforces and oversees laws related to minimum wage, overtime pay, employee benefits, workplace safety, unemployment insurance, workers' compensation, and other labor-related matters. The department also provides resources and assistance to job seekers, job training programs, and statistical data on the labor market.

Who is required to file federal labor department?

Employers are required to file with the federal labor department.

How to fill out federal labor department?

To fill out federal labor department forms, follow these steps:

1. Obtain the form: Visit the official website of the federal labor department, such as the U.S. Department of Labor website, and locate the specific form you need to fill out. Forms are usually available in PDF format and can be downloaded and printed.

2. Read the instructions: Before filling out the form, carefully read the instructions provided. Instructions will guide you on how to properly complete each section of the form and any specific requirements or additional documents needed.

3. Gather required information: Collect all the necessary information and documents you will need to complete the form. This may include personal details, employment history, income information, and any supporting documentation or identification.

4. Start filling out the form: Begin by providing your personal information, such as your name, address, Social Security number, and contact information. Ensure the accuracy of the information you provide.

5. Provide requested details: Proceed to the designated sections of the form and answer the questions or provide the requested details. This may include details about your employment history, reason for filling out the form, specific claims or issues you are addressing, and any other relevant information.

6. Be accurate and concise: Make sure to provide accurate and truthful information while being concise and using clear language. Double-check the form for any errors or omissions before submission.

7. Attach supporting documents if required: Some forms may require additional supporting documents, such as pay stubs, contracts, or medical records. Attach these documents as instructed and ensure they are relevant and up to date.

8. Review and sign the form: Once you have completed the form, carefully review it to ensure all information is accurate and complete. Sign and date the form in the provided section before submission.

9. Submit the filled form: Follow the instructions provided on the form to submit it. In most cases, forms can be submitted electronically, by mail, or in person. Choose the appropriate submission method based on the instructions provided.

It is essential to comply with the specific requirements and deadlines outlined by the federal labor department for each form. If you have any doubts or questions, it is advisable to consult their official website or seek assistance from their helpline or office.

What is the purpose of federal labor department?

The purpose of a federal labor department, such as the United States Department of Labor, is to promote and enforce labor and employment laws, regulations, and policies at the federal level. It plays a crucial role in ensuring fair and safe working conditions, protecting the rights and interests of workers, and fostering a competitive and productive workforce. The key objectives of a federal labor department typically include:

1. Protecting workers' rights: The department works to secure and safeguard the rights of workers, including the rights to fair wages, safe working conditions, and freedom from discrimination, harassment, or exploitation.

2. Enforcing labor laws: It enforces various federal labor laws, such as the Fair Labor Standards Act, Occupational Safety and Health Act, and Family and Medical Leave Act, to ensure compliance by employers. This includes conducting inspections, investigations, and audits to identify and rectify violations.

3. Promoting fair employment practices: The department aims to eliminate discrimination in employment based on factors such as race, gender, age, disability, or national origin. It enforces laws such as the Equal Employment Opportunity Act and ensures equal opportunity for all individuals in the workplace.

4. Providing job training and employment services: Federal labor departments often have divisions dedicated to providing job training, career counseling, and employment services to help individuals find suitable employment and enhance their skills.

5. Collecting and analyzing labor market data: They gather and analyze data regarding employment, wages, working conditions, and labor market trends. This information helps in formulating policies, regulations, and programs that address the needs of workers and assist in economic planning.

6. Administering employee benefit programs: Federal labor departments may oversee or administer programs related to workers' compensation, unemployment insurance, pension plans, and healthcare for certain groups of workers.

Overall, the purpose of a federal labor department is to foster a balanced and equitable relationship between workers and employers, ensuring that labor standards are upheld and workers are protected from unfair practices in the workplace.

What information must be reported on federal labor department?

The information that must be reported to the federal labor department varies depending on the specific requirements and regulations of the country. In general, however, the following information is commonly reported:

1. Employee Information: This includes details such as employee names, social security numbers, addresses, and employment dates.

2. Wage and Hour Data: Employers must report employee hours worked, wages paid, and any overtime or other compensation provided. This information helps ensure compliance with minimum wage laws, fair labor standards, and overtime regulations.

3. Employment Taxes: Employers must report and pay various employment taxes such as Social Security, Medicare, and federal income tax withholding. This includes reporting the amount withheld from employee paychecks and the employer's share of these taxes.

4. Workplace Injuries and Illnesses: Employers are required to report any workplace injuries, illnesses, or fatalities to the Occupational Safety and Health Administration (OSHA). This helps in tracking and prevention of workplace hazards.

5. Family and Medical Leave: Employers who are covered by the Family and Medical Leave Act (FMLA) must maintain records related to employee requests for leave and the duration of the leave taken.

6. Equal Employment Opportunity: Employers may need to report information related to compliance with equal employment opportunity laws such as the number of employees by job category, race, ethnicity, and gender.

It's important to note that specific reporting requirements may vary depending on the type of business, industry, and size of the company. It is advisable to consult with the relevant labor department or legal counsel to ensure compliance with all reporting obligations.

What is the penalty for the late filing of federal labor department?

The penalty for the late filing of federal labor department documents can vary depending on the specific document being filed and the circumstances surrounding the late filing. Generally, late filings may result in the imposition of fines or penalties by the Department of Labor (DOL). The specific penalty will be determined based on the discretion of the DOL and can depend on factors such as the nature of the violation, the size of the employer, or the length of the delay.

It is advisable to consult the specific filing requirements and guidelines provided by the DOL, as well as any applicable regulations or statutes, to determine the applicable penalties for late filings in a particular situation.

How do I make edits in federal labor department without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing irs deductions form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my employee termination form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your termination form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I edit employee termination form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing irs deductions form right away.

Fill out your federal labor department form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Termination Form is not the form you're looking for?Search for another form here.

Keywords relevant to federal labor form

Related to certification deductions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.